The Integrated Facilities Management industry is experiencing unprecedented growth, with the Indian market positioned as a global leader in innovation and expansion. As businesses increasingly recognize the value of comprehensive facility management solutions, the landscape is evolving rapidly with new technologies, initiatives towards sustainable maintenance operations, and service integrations that are redefining how organizations manage their built environments.

Market Growth: Impressive Numbers Tell the Story

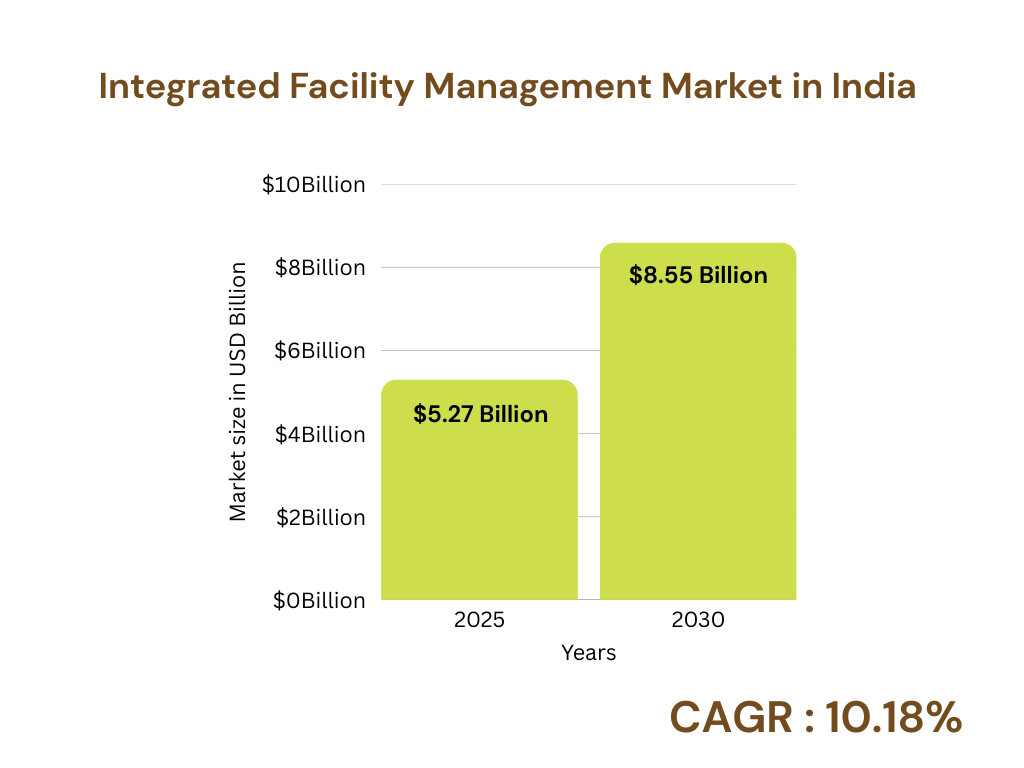

The integrated facility management services sector is witnessing remarkable expansion. According to Mordor Intelligence, the India Integrated Facility Management Market size is expected to reach USD 5.27 billion in 2025, growing at an impressive CAGR of 10.18% to reach USD 8.55 billion by 2030. This growth trajectory from the 2024 market size of USD 4.73 billion demonstrates the sector’s robust potential.

This exponential growth reflects the increasing demand for facility management solutions across various industries, driven by urbanization, infrastructure development, and the need for operational efficiency.

Key Trends Defining the IFM Space in 2025-2026

1. Hard FM and HVAC Services Leading the Charge

The Hard FM and HVAC segment is expected to hold significant market share in the coming years. This trend is driven by several factors:

- MEP Services Expansion: Mechanical, Electrical, and Plumbing (MEP) services are experiencing surge in demand due to India’s booming commercial real estate market and rapid urbanization.

- Focus on HVAC Maintenance: The flourishing construction sector has created pronounced growth in HVAC maintenance services, aligning with carbon emission reduction goals.

- Government Commitment: Prime Minister Shri Narendra Modi’s reaffirmation of India’s commitment to achieving net-zero emissions by 2070 in September 2023 is driving demand for energy-efficient systems.

2. Green Building Certifications and Sustainability

The push for green building certifications, notably LEED and IGBC, is amplifying demand for:

- Energy-efficient HVAC systems

- Sustainable hard facility management practices

- Environmental control systems in industrial settings

- Smart building technologies that optimize resource consumption

3. Government and Infrastructure Sector Boom

The Government, Infrastructure, & Public Entities sector is set to be a major driver for facility management services. Key initiatives fuelling this growth include:

- Pradhan Mantri Awas Yojana (PMAY)

- Smart Cities Mission

- National Infrastructure Pipeline (NIP)

- Bharat Mala road projects

4. Regional Growth Patterns: North India Leading

North India is expected to hold significant market share, driven by:

- Rapid expansion of corporate offices in Delhi, Gurgaon, and Noida

- Major IFM vendors like SIS Limited, Lions Services, and Impression Services being headquartered in the region

- Industrial development initiatives, including Uttar Pradesh government securing almost 1,000 acres in Agra for extensive industrial development in September 2024

5. Commercial and Retail Sector Expansion

Cities like Delhi and Gurgaon are rapidly expanding their commercial real estate sectors, with:

- Influx of multinational companies and startups

- Development of residential facilities and shopping malls

- Increased demand for integrated services including cleaning, security, catering, HVAC maintenance, and landscaping

Economic Impact and Construction Sector Growth

The construction industry’s contribution to India’s GDP has grown significantly:

| Q4 2021 | INR 2,430.71 billion (USD 28.91 billion) |

| Q4 2023 | INR 3,610 billion (USD 42.94 Billion) |

This growth directly correlates with increased demand for facility management solutions across all sectors.

Future Outlook: What to Expect in 2025-2026

Service Integration and Specialization

- Comprehensive integrated facility management services covering hard and soft FM

- Specialized services for specific industries and sectors

- Enhanced focus on sustainability and efficiency with managing utilities (energy & water)

Technology Adoption

- Increased automation and IoT integration

- Predictive maintenance solutions

- Data-driven decision making for optimised facility operations

Market Expansion

- Continued growth in tier-2 and tier-3 cities

- Expansion of services to emerging sectors

- International partnerships and collaborations

Regulatory Compliance

- Alignment with environmental regulations and green building standards

- Enhanced safety and security protocols

- Digital compliance and reporting systems

Conclusion

The integrated facility management space in India is poised for transformational growth in 2025-2026. With market size expected to reach USD 5.27 billion in 2025 and growing at a CAGR of 10.18%, the sector presents immense opportunities for both established players and new entrants.

For organizations seeking integrated facility management services, India’s rapidly expanding market offers a unique mix of innovation, sustainability, and comprehensive solutions designed to meet the demands of modern businesses. The convergence of government initiatives, technological advancement, and increasing awareness of operational efficiency will continue to drive demand for sophisticated facility management solutions.

As the industry evolves, companies that can successfully integrate technology, sustainability, and comprehensive service delivery will emerge as leaders in this dynamic and rapidly growing market. The trends identified for 2025-2026 indicate a mature, technology-driven market that promises significant returns for stakeholders while contributing to India’s broader economic and environmental goals.

Partner with Nanya for Next-Generation IFM Solutions

Nanya stands at the forefront of integrated facility management services, combining cutting-edge technology with sustainable practices to deliver exceptional results. As one of the leading providers in the industry, we understand the complexities of modern facility management and offer comprehensive solutions tailored to your unique needs.

Why Choose Nanya Services LLP?

- Proven Expertise – Deep industry knowledge with track record of successful implementations

- Technology-Driven Solutions – Advanced automation and IoT integration for optimal efficiency

- Sustainability Focus – Green building practices aligned with India’s net-zero emissions goals

- Comprehensive Services – Complete hard FM, soft FM, and HVAC management under one roof

- Cost Optimization – Proven strategies to reduce operational costs while improving service quality

Get Your initial Facility Management Consultation done by our experts who will analyse your current operations and provide customized recommendations to help you leverage the emerging trends in the IFM space. Talk to us and discover how our integrated facility management solutions can drive your business success in 2025 and beyond.

Visit us at: www.nanya.llc

Source: https://www.mordorintelligence.com/industry-reports/india-integrated-facility-management-market

Frequently Asked Questions (FAQs)

1. What is the difference between FM and IFM?

FM (Facility Management) handles individual services separately, while IFM (Integrated Facility Management) combines all facility services under a single provider for streamlined operations and cost efficiency.

2. What are the benefits of integrated facility management?

IFM offers cost savings, improved operational efficiency, single-point accountability, better coordination between services, and enhanced performance through technology integration.

3. What is the purpose of IFM?

The purpose of IFM is to consolidate all facility management functions into one comprehensive solution that optimizes building performance, reduces costs, and improves occupant experience.

4. How big is the Indian IFM market expected to grow by 2030?

The Indian IFM market is projected to reach USD 8.55 billion by 2030, growing at a CAGR of 10.18% from USD 5.27 billion in 2025.

5. Which sectors are driving the highest demand for IFM services in India?

Government infrastructure, commercial real estate, manufacturing industries, and retail sectors are the primary drivers of IFM demand, with Hard FM and HVAC services leading growth.